Late stage private technology companies have fewer reasons to go public today than they did a decade ago. With the abundance of private capital available–and a record $230B1 in dry powder amongst venture capital firms– venture-backed companies are increasingly reaching valuations of $1 billion and even $10 billion before they go public.

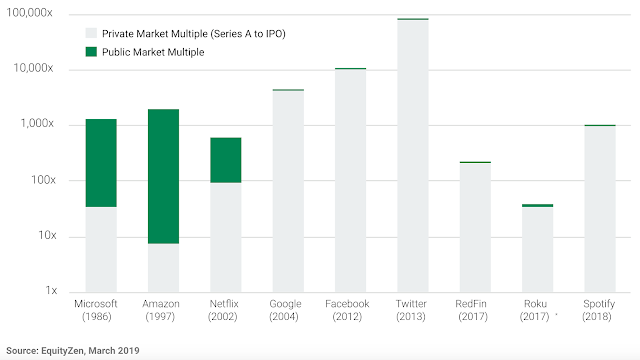

While these companies may still have upside in public markets, the magnitude of growth that pre-IPO investors experience can be substantial. Furthermore, recent market volatility has proven that the 60/40 portfolio model is broken. Public market investors are missing out on private market value creation, which has created a need for advisors to tap the pre-IPO secondary market to help generate meaningful returns for their clients.

The graph above displays how value creation from 1986 through 2018 has shifted from the public markets (green) to the private markets (gray). Roku's private valuation multiple based on Series B to IPO. Companies shown may not be actual portfolio investments of any EquityZen fund.

In the pre-IPO secondary market, shareholders of private, venture-backed companies transfer the ownership of their shares to investors as a means of getting liquidity before a company-wide exit event. The investor exchanges cash for shares of the private company and the proceeds of the sale go to the selling shareholder. If the company goes public, investors typically receive shares after the IPO lockup period. If the company gets acquired for cash, investors receive cash for their shares.

The pre-IPO market spans industries including: enterprise software, cloud computing, big data, cybersecurity, health tech, fintech, artificial intelligence, gaming, and more. Private companies within these industries include household names like Reddit, Bytedance, and Stripe. According to CB Insights, over 1,200 companies globally have a private-market valuation above $1 billion. These “unicorns” represent a tremendous $3.8T of value locked up in the pre-IPO market.

Over the last 25 years, top-quartile VC firms generated returns of 18.9% to 25.1%, while the public markets returned less than 13%2. EquityZen’s secondary market is unlocking this return potential for investors who had previously been shut out due to high investment minimums and exclusivity. Through the secondary market, advisors can invest in companies backed by top-tier venture capital firms and drive returns on behalf of their clients. In fact, there is a correlation between secondary activity and higher post-money valuations at each stage. Furthermore, the current market environment has created opportunities to invest in private companies at attractive valuations.

How Advisors Allocate to the Pre-IPO Market

Late-stage private companies like Stripe are certainly different from early-stage companies with high market and execution risk. These companies have proven business models with many generating hundreds of millions of dollars of revenue and employing thousands of workers. Ten years ago, when companies went public earlier in their life cycle, these companies would already be publicly traded. For this reason, many advisors consider late-stage private company investments as part of their growth equity allocation. Especially for advisors who maintain a sizable allocation to the technology sector, these investments complement their public market technology allocation, while offering some stability from the day-to-day public market shifts.

It is important to note that pre-IPO investments don’t typically offer near-term liquidity. Because of this, advisors should only allocate assets to private investments that will not be needed in the near-term (at least 2 years from investment, and typically longer). Private company investments are typically held until there is an exit event for a given company, which can take years, though products like EquityZen’s Express Deals can provide earlier liquidity. Given this liquidity consideration, pre-IPO investments should also be considered in the context of a client’s overall illiquid or long-term investment allocation.

Ultimately, advisers allocate to the pre-IPO market with the goal of driving attractive investment returns for their clients. Venture Capital strategies outperformed the S&P 500 by 2-3x over 20-25 years and investments on EquityZen’s platform have seen returns that asymmetrically skew to the upside. While there are risks involved, including loss of investment, advisers are keen to offer diversification beyond public equities while offering potentially higher returns through pre-IPO investments.

Diversification

Depending on a client’s overall portfolio, advisors may look to invest in single private companies or access the pre-IPO market via a diversified fund. Advisors with clients who already invest in single company stocks may choose to invest in individual private companies. EquityZen’s platform provides individual company research to aid advisors in analyzing potential investments. However, it should be noted that private companies typically disclose less information than you’d find for a public company because they don’t have the same regulatory reporting requirements. This potential lack of information can make pre-IPO investments riskier.

Diversified managed funds provide exposure to the broader pre-IPO market or may target a specific sector or theme (e.g. Artificial Intelligence and Machine Learning, Fintech). EquityZen’s Thematic and Global Opportunity Funds serve this purpose. Some advisors find that these diversified products help mitigate some of the risks of single-company investments and offer a more comfortable entry point into pre-IPO investing. This investment approach makes sense for advisors who typically don’t invest in individual public companies and instead seek broader, diversified market exposure.

The Future of the IPO Market

Despite current market conditions, advisors continue to turn to the secondary pre-IPO market to find attractive investment opportunities. This year has proven that the 60/40 portfolio is no longer sufficient to provide the best risk-adjusted returns. As advisors look to incorporate alternatives into their client’s portfolios, secondary pre-IPO investments can play an important role in their overall investment allocation. It remains an exciting time for pre-IPO investors and EquityZen remains focused on opening access to investment opportunities and offering solutions that advisors need. As the private market grows, pre-IPO secondary investments will become increasingly important to drive meaningful returns and a well-balanced portfolio.

Sources:

- The Information, September 2022

- Alumni Ventures, 2019

- Aumni, 2022

- As of 6/30/2019, Cambridge Associates

.png?width=812&height=446&name=Q1%20(1).png)