One of the most common questions we get asked from both our shareholder and investor clients is how we determine the pricing of secondary transactions on EquityZen's marketplace. After all, a risk of the private markets is that they can be be opaque, lacking the information typically available in the public market. One tool investors have is the Private Market Valuations Trend chart in their EquityZen Dashboard. Another tool available to shareholders is our Equity Value Calculator. While these tools provide some intel on secondary pricing, there is more to know.

Each investment opportunity offered on EquityZen's platform is carefully vetted by our Research Team who determines the appropriate pricing range for a given company in realtime. Over EquityZen's 10-year history our team has become experts on secondary transaction pricing, leveraging data from over 45,000 prior secondary transactions in 450+ companies along with bids, asks and other proprietary information from our marketplace when making their pricing decisions. It's both an art and a science. Here, we'll breakdown some of the key components of our pricing framework and give you a sneak peek into the pricing process.

Quantitative Factors

These are the cold hard numbers that help inform how we price a given company's shares. Some of the key quantitative factors we consider include:

- Last funding round's price: one of the primary pricing anchors we use as a benchmark is the price at which the company last raised private capital. This is the price that the institutional investors last paid to invest in the company in a primary funding round. Part of this process includes recreating the capitalization table for each private company to determine the number of shares outstanding.

- Public market comps: we analyze the performance, market cap, multiples and key financial metrics for any public market competitors of a given private company. Because this information is readily available for public companies this is an important input as we consider pricing a given secondary transaction.

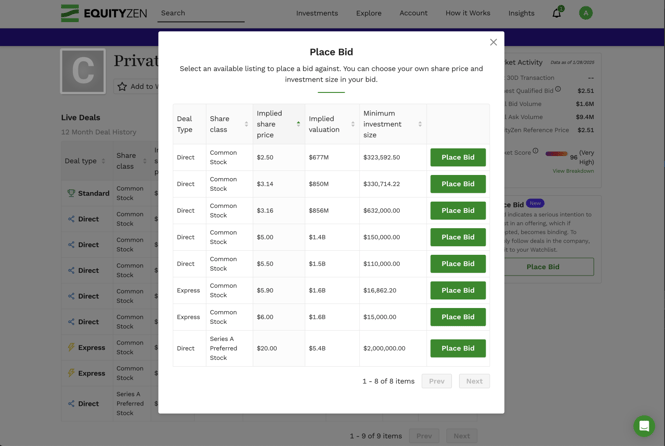

- Secondary transaction history: our team leverages the rich dataset of secondary transaction data from EquityZen's marketplace to inform our pricing. We look at where a company's shares have traded on the private market over time, where their private market competitors are trading and where investors and shareholders have submitted bids and asks.

- Sector trends: we look at the performance of a given sector in the public markets to understand the broader macro trends that may be impacting the valuation for a company in a given industry.

- Company financials: when available, our team analyzes any publicly disclosed financials about a given company. We look at these numbers versus the relevant competitor comps and use this to benchmark pricing.

- Security type: common shares typically trade at a discount to preferred shares given the liquidity preference that is awarded to preferred shareholders. This is a key consideration when determining the price for a given secondary transaction.

Qualitative Factors

Pricing secondary shares also takes into account more qualitative considerations about a given company. These include both positive and negative business developments including layoffs, lawsuits and an increasingly adverse regulatory landscape along with news about new product launches, headcount growth and other positive developments.

These are just some of the inputs that EquityZen's research team uses to price secondary transactions. With other factors, they are run through our proprietary pricing algorithm which determines the appropriate pricing range for a given company's shares at a given time. This algorithm has been continually tweaked to maximize accuracy and take into account the broader macro factors that impact how shares of both private and public companies trade. We rerun it for each subsequent secondary transaction in a given company.

Hopefully you now better understand EquityZen's approach to secondary transaction pricing. Our goal is to make sure our investors and shareholders feel confident that they are buying and selling shares at a fair market price, and this methodology acts as a guide. At the end of the day, a buyer and seller must agree upon the price for a deal to happen and EquityZen's role as a marketplace is to facilitate deals between buyers and sellers at the price where supply and demand intersect.

Curious to learn more about where private companies are trading in the secondary market? Check out the Private Market Valuation Trench chart in your Dashboard. Shareholders of private company shares can also try out our Equity Value Calculator.

![]()

Interested in exploring EquityZen's private company marketplace?

An investment through EquityZen's platform will involve risks not associated with other investment alternatives. Prospective investors should carefully consider, among other factors, risks.

.png?width=96&height=96&name=image%20(5).png)