The crypto market is booming. A number of industry tailwinds have enabled growth in the market - from a crypto friendly administration to Circle’s blockbuster IPO earlier this year. The global cryptocurrency market capitalization stands at $3.76 trillion. Meanwhile, total cryptocurrency trading volume reached $262.10 billion. These values reflect growing investment interest in this highly volatile industry.

Crypto company exits have dominated recent headlines, further fueling investor appetite. Circle Internet Group's record-breaking IPO in June 2025 seemingly catalyzed a trend of digital asset companies going public. Since then, Bullish, Figure Technologies, and Gemini have launched IPOs, crypto custodian BitGo has filed its S-1 with the SEC, and crypto-exchange Kraken is reportedly preparing for its own market debut. Alongside IPO exits, over 100 mergers and acquisitions have taken place in the crypto space since the beginning of the year. The crypto market is not without risk, as companies face significant price volatility within digital assets and an uncertain regulatory environment.

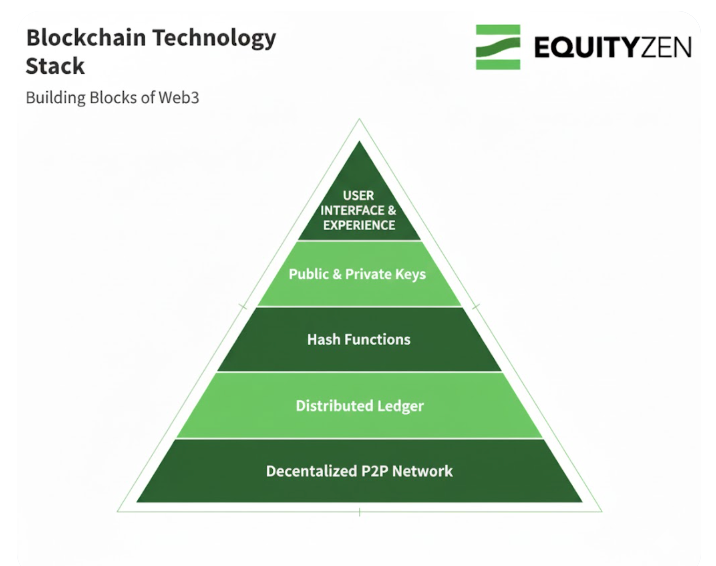

Recent news and technology enhancements have drawn attention to the private companies building the ecosystem's foundational technology. Here we breakdown the fundamental technology driving blockchain’s growth, leading private companies and the risks and opportunities cryptocurrency can unlock for investors today.

What is blockchain?

Blockchain is a decentralized, distributed ledger technology that maintains a fixed, chronologically ordered record of transactions. To understand the rudimentary elements of blockchain, consider the rules of Scrabble. The board represents the shared public ledger, and each word placed upon it is a block of data. The chain is formed by the game's fundamental rule: every new word must be physically linked to a pre-existing one, creating a single, interlocking grid. Attempting to retroactively change any of the words would ruin the structural integrity of the game, invalidating all future, interconnected words. This makes any edits to the structure of the board evident to all players. Like a Scrabble board, blockchain is a system that can only be added to, rather than edited.

So, what makes a blockchain so secure? It boils down to a few key mechanisms working together to protect the integrity of the whole system. Some of the core mechanisms include:

- Decentralized P2P Network: The foundational network of computers (nodes) that operate without a central authority. This creates a resilient system with no single point of failure.

- Distributed Ledger: The shared, synchronized database across all nodes, ensures transparency by establishing a single, verifiable source of truth for all participants.

- Hash Functions: These create a unique, digital fingerprint (a hash) for each block in the chain. By including the previous block's hash, they form the secure, interlocking chain.

- Public & Private Keys: Keys help to secure ownership of an asset. The public key acts as your address, while the private key is the password used to authorize transactions.

These features highlight blockchain's key goals: security, transparency, and decentralization. The network of nodes provides the foundation for transactions to occur, which are recorded in the distributed ledger to ensure transparency for all participants. Hash functions create the secure, chronological chain, making the ledger immutable, while public and private keys provide security for each individual transaction.

The Role of Consensus Mechanisms

Consensus mechanisms enable transaction validation without a central authority. These automatic processes are completed almost instantaneously.

- Proof-of-Work (PoW): Network participants, or miners, compete to solve a complex computational puzzle. The first miner to find the solution gets to propose the next block for the chain and is rewarded for their computational work.

- Proof-of-Stake (PoS): Participants, or validators, who have staked cryptocurrency as collateral, are randomly chosen to create new blocks and update the ledger. This stake incentivizes honest behavior, as non-compliant actions can result in the loss of funds.

Blockchain’s Major Use Cases

Payment via Cryptocurrencies and Stablecoins

Cryptocurrency is the native digital asset of a blockchain. Each cryptocurrency balances three benefits of the blockchain: decentralization, scalability and security.

The value of any individual cryptocurrency is based on its utility, demand, scarcity (e.g., Bitcoin's has a supply of 21 million coins), and the overall security of its decentralized network. However, the price volatility of cryptocurrency may present challenges for everyday transactions. Bitcoin faced one of the largest crypto liquidations in October 2025, reportedly dropping over 5% in less than 10 minutes, caused in part by over-leveraged positioning.

Stablecoins aims to solve the volatility challenge. They are a class of cryptocurrency that is pegged to a real-world asset. There are two main types of stablecoins:

- Fiat-Collateralized: Backed 1:1 by currency held in a reserve. One of the most popular examples is USDC, governed by Circle.

- Crypto-Collateralized: Backed by other cryptocurrencies (ex. DAI on the Ethereum blockchain).

DeFi, Payments, and Tokenized Securities

Blockchain has begun unlocking a host of alternative financial applications focused on transparency, payment enablement, and access to assets.

- Decentralized Finance (DeFi): Financial applications built on blockchain, allowing users to lend, borrow, trade, and earn interest without traditional intermediaries like banks.

- Cross-Border Payments: International payments can be settled in minutes, bypassing slow and costly banking systems (e.g. Ripple’s cross-border payment solution).

- Tokenized Securities: Assets like stocks, bonds, and real estate can be represented as digital tokens on a blockchain. This process allows for fractional ownership, increases liquidity, and automates compliance and dividend distribution via smart contracts. Popular trading platforms like Robinhood offer these stock tokens as derivatives on the blockchain.

NFTs and Verifiable Digital Ownership

While cryptocurrencies are fungible (mutually interchangeable), Non-Fungible Tokens (NFTs) are unique and cannot be replaced. Each NFT is a digital certificate of authenticity and ownership recorded on a blockchain. This creates digital scarcity, enabling applications like:

- Gaming: Verifiable ownership of game assets that can be traded. For example, Epic Games, the creator of Fortnite, uses the Polygon blockchain to create unique user identities and allow players to interact with game features.

- Ticketing: Fraud-proof tickets for events (e.g. Seatlab, an NFT ticketing marketplace).

- Credentials: Academic or professional certificates that are instantly verifiable.

Transforming Industries and Governance

The principles of transparency, immutability, and decentralization can be applied across virtually any industry. Here are some real-world examples of how crypto is changing traditional industries.

- Healthcare: Medical records can be managed securely, giving patients control over who can access their health data.

- Supply Chain Management: Companies can track products from production to delivery, verifying authenticity and improving transparency.

- Media & Entertainment: Smart contracts can automate royalty payments to artists, ensuring fair and immediate compensation.

Blockchain’s Risks

While blockchain technology offers unprecedented opportunities for innovation and decentralization, it's crucial to understand its inherent risks. The security and reliability of any blockchain-based system depend on both the architecture of the network itself and the quality of the code it executes.

Security Level

Blockchain networks operate on varying levels of security, including public blockchains, private blockchains, permissionless blockchains, and permissioned blockchains. These network protections affect who can validate transactions. For various applications, individuals should consider the sensitivity of their data and their risk appetite in a peer-to-peer network. Furthermore, like any digital commodity, blockchain is exposed to the threat of fraud and cyberattacks. Non-compliant individuals may attempt to access private credentials, intercept data transferred across servers, create false identities, or accumulate enough computing power to have majority control over a network.

Smart Contract Bugs

Vulnerabilities in the code of smart contracts can present permission control risks, transaction errors, or lack of validation. To mitigate these risks, it is important to understand the authorization mechanisms, input data, and logic behind the smart contracts on the network.

The Private Crypto Market

Private market appetite for crypto investments has grown notably in 2025. In part, this trend can be attributed to the passing of the first federal legislation to regulate stablecoins in the United States. The Digital Asset Market Structure Clarity Act of 2025, which would help provide a regulatory framework for digital assets, has passed in the House and awaits Senate consideration. This federal regulation will enable growing adoption of blockchain technology.

VCs are making larger, more concentrated bets in the crypto and blockchain sector. Despite a 40% drop in global deal counts from 2024, the total capital raised year-to-date ($11.17B) has nearly matched the full-year total for 2024.1 This trend has fueled a strong market for top performers with an estimated 75 private, VC-backed US companies in the space achieving unicorn status. This includes leaders like Revolut, BITMAIN, Kraken, Ripple, and OpenSea.

On EquityZen’s platform, investor interest in private cryptocurrency and blockchain companies have increased by more than 5 times year over year.2 The most significant spike in interest occurred in June 2025, the month of Circle’s headline-defining IPO. Deals closed in the sector have also increased year-over-year from 2017 to 2024, with the exception of 2022’s recovery from 2021 highs.3

Below are some of the private companies driving innovation within the private crypto market:

| Sector | Company Name | Description |

|---|---|---|

| Crypto Wallets & Exchanges | Kraken | A digital asset trading platform that provides crypto tools and advanced trading strategies to investors, offering access to more than 450 cryptocurrencies and 11,000 stocks and ETFs, as well as support for 15 stablecoins and 10 fiat currencies. |

| BitPay | Aims to provide enterprise-grade bitcoin payment solutions for businesses and individuals. | |

| Blockchain.com | A crypto exchange and wallet platform, allowing users to buy and store digital tokens. | |

| Crypto Custodians | BitGo | A security platform and multi-sig technology company that serves institutions via digital asset custody and liquidity. |

| Fireblocks | A cryptocurrency institutional custody startup that supports the security of digital assets. | |

| Global Payment Systems | Ripple | The creator of XRP and blockchain technology aimed at creating a decentralized network that allows businesses, governments, and individuals to send and manage assets across borders. |

| Blockchain Development Software | Consensys | An integrated software company that develops technology that the company claims enables access to and construction of web3 applications. |

| Alchemy | Alchemy is the provider of a blockchain development platform that helps developers build and scale web3 applications. | |

| Other | Polymarket | A prediction market built on blockchain technology with transactions denominated in a US-dollar pegged stablecoin, USDC. Investors can buy and sell shares representing future event outcomes ranging from crypto price range estimates to global election results to predicting the highest grossing movie of the year. |

Looking Forward

The cryptocurrency market is rapidly evolving, moving beyond the volatility of coin prices to the fundamental value of its underlying technology. As we've explored, the real innovation lies in the application of blockchain—a secure, decentralized ledger powering everything from DeFi and tokenized real-world assets to NFTs and more efficient global supply chains. While the industry certainly carries unique risks, the trend toward maturity is undeniable.

The recent surge of high-profile IPOs and concentrated VC funding signals that the market is focusing on the leading companies building the core infrastructure for this new digital economy. Understanding this foundational layer—the technology, the use cases, and the key private players—is no longer optional. It's essential for investors seeking access to a market that is fundamentally reshaping how we transact, own, and create value.

Footnotes

- 1. PitchBook Data as of 10/17/2025

- 2. EquityZen Data as of 10/20/2025.

- 3. EquityZen Data as of 10/20/2025.

.jpg?width=1318&height=736&name=shutterstock_542978641%20(1).jpg)