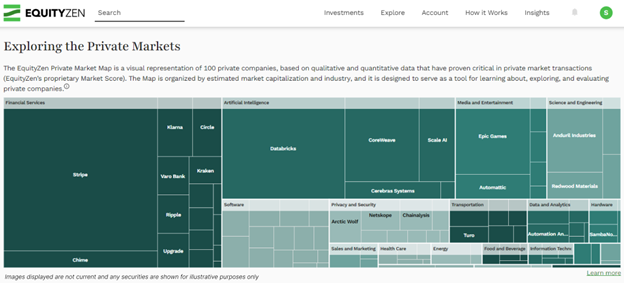

From Arm to Instacart to Klayvio, more technology companies are entering the public markets. Eyes are on other private unicorns & decacorns to see who may IPO next. By the time many of these companies meet this milestone, most of the growth has already happened. At EquityZen, that's why we're focused on the "Next Ones". Here, we've compiled a list of the most promising private companies that we expect to dominate the private secondary market, and eventually the public markets, in the coming years.

We took a quantitative approach to crafting this list, based on a few key criteria that we believe indicate a high potential for growth and future success. Specifically, our criteria filtered for private companies that:

Raised funding in the last 12 months from an investor whose firm is on the Midas list. At EquityZen, we look to follow the lead of the best tech investors. This list ranks institutional investors based on the exits and private valuations they've achieved over the past five years. Furthermore, any companies that have been able to raise funding from top-tier investors in this tough fundraising market are clearly showing strength.

Raised $20 to $200M in funding in their latest funding round1. We aimed to focus on the companies that have raised enough money to be considered early-mid stage, while not too large yet.

Are valued at less than $1 billion. Again, we want to focus on the next big names, not the current ones.

Are US-based. U.S. based companies tend to be most active in the U.S. private secondary market where EquityZen operates.

Achieved headcount growth of 200%+ in the last 12 to 24 months. In an environment riddled with layoffs, companies that have continued to grow their teams are in a strong position for continued growth.

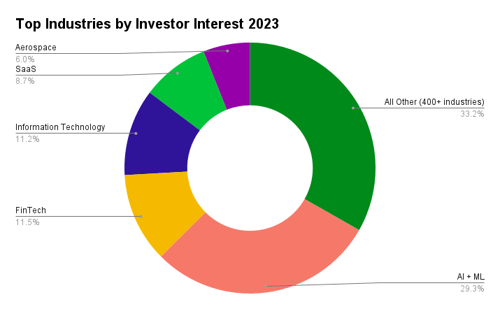

This year’s list includes companies from a wide range of industries from enterprise software () to environmental services () and aerospace (). Many of these industries align with the most popular industries amongst EquityZen investors like artificial intelligence () - unsurprisingly the most in-demand industry throughout the year - information technology () and software-as-a-service. These companies are solving problems through innovation for a broad set of end users from contractors to developers, technicians, security teams and government agencies.

This year’s list includes companies from a wide range of industries from enterprise software () to environmental services () and aerospace (). Many of these industries align with the most popular industries amongst EquityZen investors like artificial intelligence () - unsurprisingly the most in-demand industry throughout the year - information technology () and software-as-a-service. These companies are solving problems through innovation for a broad set of end users from contractors to developers, technicians, security teams and government agencies.

Now, let's dive into the list. Meet this year's "Next List" companies in the private secondary market.

Investor interest by industry as indicated by investors on EquityZen's platform year-to-date. As of October 13, 2023

BuildOps

- What they do: BuildOps is an all-in-one project management platform built specifically for the modern commercial specialty contractor. Focusing on trade contractors, BuildOps combines service, project management, and more into a single SaaS platform.

- Industry: Business/productivity software

- Founded in 2018 in Santa Monica, CA

- Latest Round: $93M Series A2 in May of 2023 at a $300M post-money valuation led by P Ventures, Next47, and 01 Advisors

- What’s next: In July 2023 BuildOps announced their acquisition of PWSWARE, the parent company to Perfectware Solutions and Shark Byte CRM, in a move to bring the best of construction technology to a wider audience.

Charm Industrial

- What they do: Charm is a carbon removal technology company that uses plants to capture CO₂ from the atmosphere. The company converts biomass into a stable, carbon-rich liquid and then pumps it deep underground. This removes CO₂ permanently from the atmosphere, out of reach of wildfires, soil erosion and land use change.

- Industry: Industrial/Environmental Services

- Founded in 2018 in San Francisco, CA

- Latest Round: $100M Series B in June 2023 at a post money valuation of $630M led by General Catalyst

- What’s next: According to a company blog post, Charm Industrial expects to add up to 200,000 jobs to the US Economy and over $20B in new GDP by 2040.

Cortex

- What they do: Cortex is an internal developer portal with a mission to accelerate the path to engineering excellence. Companies like Docker, TripAdvisor, and Confluent use Cortex to catalog, score, and assign action to improve service quality and velocity, so devs can focus on work that drives their business forward2.

- Industry: Business/Productivity Software

- Founded in 2019 in San Francisco, CA

- Latest Round: $35M Series B in April 2023 at a post money valuation of $295M led by IVP

- What’s next: According to a May 2023 TechCrunch article, Cortex saw its revenue grow 400% year-over-year. Cortex also welcomed new customers including TripAdvisor, Docker, Grammarly, Unity and SoFi.

Cyera

- What they do: Cyera is building a data security platform that delivers the ease, agility, and robust protections security teams demand. Cyera aims to help security teams procure and connect their solution to a cloud solution provider platform.

- Industry: Information technology/network management solution

- Founded in 2020 in San Mateo, CA

- Latest Round: $100M Series B in June 2023 at a post money valuation of $500M led by Accel

- What’s next: In June of 2023 Cyera’s CEO announced an integration with OpenAI to accelerate multi-cloud data security. The integration tailors data security policies to help security teams make more informed data security, privacy, and governance decisions, accelerates how Cyera governs access to sensitive data, and enables Cyera’s unified policy engine to take advantage of the LLMs to identify misconfigurations, recommend specific access controls and generate new policies for data access governance.

Hex

- What they do: Hex is a data collaboration startup with a mission to change how people use data by building a collaborative, shareable analytics workspace. Hex aims to empower their users to ask new questions and share their findings in one product without any friction.

- Industry: Business/Productivity Software

- Founded in 2019 in San Francisco, CA

- Latest Round: $28M Series B in March 2023 at a post money valuation of $380M led by Sequoia Capital

- What’s next: According to a March 2023 Hex article in TechCrunch, the CEO of Hex commented that “we’ve grown revenue by 4x and the size of the business by 4x in one year”. Additionally, the company now has 450 paying customers including Brex, Notion, Toast and Chegg.

Impulse Space

- What they do: Impulse Space is a space logistics startup that develops orbital transportation vehicles. Impulse has a near-term focus on Low Earth Orbit (LEO), services include in-space transportation to custom orbits, in-space payload hosting and space asset repositioning services including deorbiting.

- Industry: Aerospace / Defense

- Founded in 2021 in Redondo Beach, CA

- Latest Round: $45M Series A in July 2023 at a post money valuation of $200M led by RTX Ventures

- What’s next: In July 2023, Impulse Space announced its LEO Express-2 and LEO Express-3 missions. These two missions will perform in-space services, including payload hosting, last-mile orbital delivery, constellation deployment, low altitude maneuvers and controlled atmospheric re-entry.

Linear

- What they do: Linear is a software company that builds issue tracking and project management tools with a mission to combine UI elegance with world-class performance.

- Industry: Business Productivity/Software

- Founded in 2019 in Covina, CA

- Latest Round: $35M Series B in September 2023 at a post money valuation of $400M led by Accel

- What’s next: According to a September 2023 blog post, Linear has operated profitably since 2021, a year after launching the product. Linear also disclosed that the company has a negative lifetime burn rate, meaning they have more cash in the bank than we have raised from investors.

Merge

- What they do: Merge offers B2B companies a single, "unified API" to connect across hundred of third-party tools

- Industry: Business/Productivity Software

- Founded in 2020 in San Francisco, CA

- Latest Round: $55 Series B in October 2022 at a post money valuation of $315M led by Accel

- What’s next: As of October 2022, the company announced that its ARR grew 30x in the past 12 months and that over 2,500 companies use their service to integrate Saas apps.

![]()

Interested in browsing the private company investment opportunities available on EquityZen's marketplace?

Metronome

- What they do: Metronome is a usage-based billing platform. Metronome claims that its offering allows companies to “quickly and effortlessly launch, iterate and scale new business models with billing infrastructure that works at any size and stage.”

- Industry: Business/Productivity Software

- Founded in 2019 in San Francisco, CA

- Latest Round: $45M Series B in May 2023 at a post money valuation of $350M led by New Enterprise Associates

- What’s next: As of June 2023, Metronome calculates millions of invoices every month. Leading companies like OpenAI, Cribl, and Starburst, rely on Metronome to power their operations.

Modular

- What they do: Modular aims to provide a cheaper alternative to AI development for enterprises through its software, bypassing the need for expensive and in-demand chips from tech companies like Nvidia.

- Industry: Information technology / software development applications

- Founded in 2022 in Palo Alto, CA.

- Latest Round: $100M Series B in August 2023 at a post money valuation of $600M led by General Catalyst

- What’s next: As of August 2023, The Modular community grew to more than 120,000 developers in the four months since May. CEO Lattner claims that “leading tech companies” are already using the startup’s infrastructure, with 30,000 on the waitlist.

Pinecone

- What they do: Pinecone is a vector database platform that is made up of engineers and scientists on a mission to build the search and database technology to power AI/ML applications for the next decade and beyond.

- Industry: Database Software

- Founded in 2019 in San Francisco, CA.

- Latest Round: $100M Series B in April 2023 at a post money valuation of $750M led by Andreeseen Horowitz

- What’s next: According to a July 2023 article Pinecone announced it has “way more than 100,000 free users and more than 4,000 paying customers,” reflecting an explosion of adoption by developers from small companies as well as enterprises that Pinecone said are experimenting with new applications.

Reka

- What they do: Reka is an AI research and product company that develops models with a mission to benefit humanity, organizations and enterprises.

- Industry: Software Development Applications

- Founded in 2022 in Sunnyvale, CA.

- Latest Round: $58M Series A in June 2023 at a post money valuation of $315M led by DST Global and Radical Ventures

- What’s next: Reka launched two early partnerships after the release of their first commercial product, Yasa. Snowflake partnered with Reka to enable Snowflake customers to deploy Yasa from their accounts. Appen, the big data analytics company, also recently announced that it’s working with Reka to build tailored multimodal model–powered apps for the enterprise.

Tractian

- What they do: Tractian is a machine intelligence company that offers industrial monitoring systems. Tractian builds streamlined hardware-software solutions to give maintenance technicians and industrial decision-makers comprehensive oversight of their operations3.

- Industry: Electronic Equipment and Instruments

- Founded in 2019 in Atlanta, GA.

- Latest Round: $45M Series B in August 2023 at a post money valuation of $205M led by General Catalyst

- What’s next: According to an August 2023 article, from 2022 to 2023 Tractian doubled its number of clients in Brazil, Mexico and the United States, reaching a total of more than 500 multinational clients such as Grupo Bimbo, La Costeña, Johnson Controls, Avon and Clarios. In addition, the company experienced 4x revenue growth between 2022 and 2023.

Tome

- What they do: Tome describes itself as a startup that uses artificial intelligence to make it easier to create and design presentations. Tome’s mission is to help users explore new approaches and instantly generate new content, so that they can get their point across compellingly.

- Industry: Multimedia and design software

- Founded in 2020 in San Francisco, CA

- Latest Round: $43M Series B in February 2023 at a post money valuation of $300M led by Lightspeed Venture Partners

- What’s next: According to an August 2023 Insider article, Tome told investors it has surpassed a $2M annual revenue run rate and currently records 10M users.

Vannevar Labs

- What they do: Vannevar Labs is a defense technology company that builds software to help solve national security problems.

Industry: Network management software - Founded in 2019 in Palo Alto, CA

- Latest Round: $75M Series B in January 2023 at a post money valuation of $575M led by Felicis

- What’s next: Vannevar's flagship product, Decrypt has been deployed across 15 agencies in the U.S. government since launching in January of 2021 and has reached $25M in sales. The company launched two additional products in new mission areas in late 2022.

Warp

- What they do: Warp is a Rust-based terminal whose goal is to re-create the command line as a modern app, making it a more usable, humane, and ultimately, more powerful CLI for everyone.

- Industry: Software Development Applications

- Founded in 2020 in New York, NY

- Latest Round: $50M Series B in June 2023 at a post money valuation of $280M led by Sequoia Capital

- What’s next: In March 2023, Warp announced it had added a new chat feature (based on ChatGPT) that will help users use the command line and troubleshoot errors. For now, Warp AI is available free of charge, with a limit of 100 requests per day. Over time, it will become a paid feature.

Interested in learning more about the innovative companies active in the private secondary market? Visit our Investments page to see what’s trending now.

![]()

Interested in browsing the private company investment opportunities available on EquityZen's marketplace?

Sources

.png?width=96&height=96&name=image%20(5).png)