VC-backed companies looking to IPO (or directly list) this year will face increased scrutiny on profitability, corporate governance and valuation expectations. Below, we’ve outlined company-specific factors we believe will affect IPOs and direct listings and the candidates seeking to go public in the near term.

Looking Back on 2019

2019 was a mixed bag for tech IPOs. While results of some offerings showed the pent-up demand for the SaaS and IaaS industries, others demonstrated the skepticism towards money losing business models. Beyond Meat, 10x Genomics and Zoom were among the success stories, while SmileDirectClub, Uber and WeWork faltered. The latter paused the IPO market in the second half of 2019, and despite see-sawing marketing conditions, companies are eyeing the public waters, learning from 2019 missteps.

Factors That Will Affect Near-Term IPOs

Profitability: Shifting Strategy from Growth to Profits

Marking a significant shift from 2019, startups are focusing on profitability in contrast to the growth-at-allcosts playbook used to achieve unicorn status. As high-profile startups like Uber and WeWork demonstrated, public investors are more skeptical of businesses that generate billion-dollar losses in favor of high growth rates. Therefore, we expect to see startups increasingly emphasize positive unit economics for mature markets and plans to achieve profitability in the near term.

Corporate Governance: Stronger Oversight on Founders

After many noteworthy missteps by some tech founders and public pressure, venture capital firms are pushing for stronger corporate governance practices. Key features investors will push for include single class voting structures (vs. dual class), independent board directors and proper disclosures in IPO paperwork (e.g., reportable segments, industry metrics and disclosures of conflicts of interest). Other items that would be welcomed are non-staggered boards, board members with adequate qualifications and experience, and non-executive chairpersons (i.e., the CEO is not the chairman of the board of directors).

Not All Startups Deserve Tech Multiples: Valuations Below Last Private Round

The notion that a tech-enabled business warrants a tech multiple has cracked. Investors will value their business based on the industry they operate in. Companies may receive favorable valuations for using technology to have more efficient operations vis-à-vis their industry peers, but their valuation will predominantly rely on industry multiples (e.g., a tech-enabled retail consumer business will receive a consumer retail multiple, not a tech multiple). Therefore, some startups may go public with valuations below their last private round.

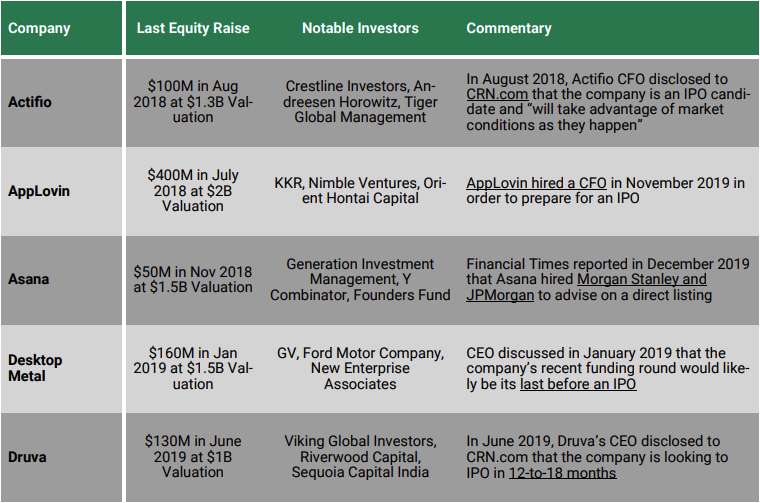

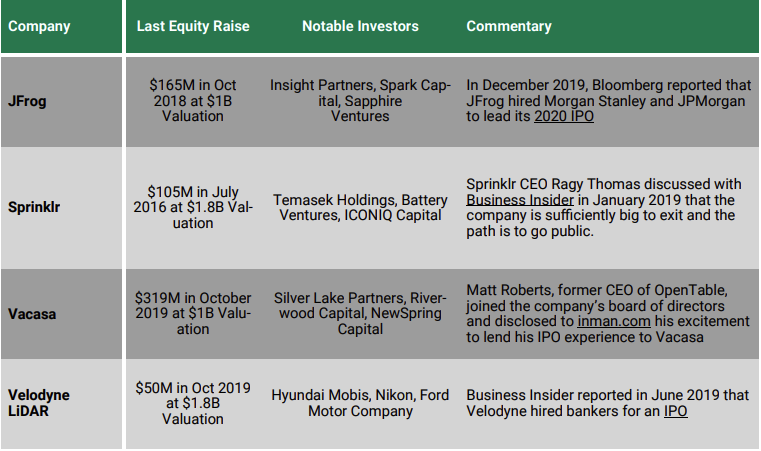

VC-Backed IPO Shortlist

We reviewed 223 U.S.-headquartered unicorns on various factors, including: 1) Have they achieved $100M in annual recurring revenue? 2) Do they have seasoned executives with public market experience? and 3) Has the company indicated it is eyeing the public markets? We believe there are nine potential near-term IPO or direct listing candidates.

Not all companies listed will complete an IPO or direct listing, and not all IPOs, direct listings will result in a successful investment.

Cautionary Note Regarding Forward Looking Statements

This article contains forward-looking statements, including, but not limited to statements about late-stage venture backed companies. We caution that these statements are not guarantees of future performance and do not constitute investment recommendations. Actual results may differ materially from those expressed or implied in the forward-looking statements. Forward looking statements involve a number of risks, uncertainties or factors beyond EquityZen's control. We undertake no obligation to update or revise the contents of this article, including any forward-looking statements, and the forward-looking, which are accurate only as of the time of this writing. Past performance is not indicative of future returns.

.png?width=96&height=96&name=image%20(5).png)