2025 has been a momentous year in the private markets.

From market-building partnerships to accelerated growth, this past year has been one of the most transformative in EquityZen’s history. But more importantly, it has been a year defined by our clients. Your demand for access to the private markets, your appetite for innovation, and your trust in our platform have driven every update we’ve shipped and every milestone we’ve reached.

As we close the books on 2025, we want to look back at what we accomplished together and share why we are more excited than ever for 2026.

2025 By the Numbers1

The stats tell the story of a market that is vibrant, active, and growing. Thanks to you, we hit some incredible new highs:

- 800,000+ Users: Our community has grown to nearly a million strong.

- 100% Increase in Transaction Count: We saw a 100% increase in transactions year-over-year, proving that despite broader market fluctuations, the appetite for private market assets is stronger than ever.

- 200% Increase in New Investors: We’ve focused on building a welcoming platform for new investors in the private markets. This year saw the number of first-time investors grow over 200%, speaking to more opportunities for new investors to access the pre-IPO market.

So what companies drove you, our clients, to invest? We close out the year with a new roster of the most popular companies. While many of these companies, like SpaceX and OpenAI, have been household names for years, some newer entrants made the list. These include Polymarket, which surged in popularity this year as prediction markets became mainstream. Here are the companies2 that were the most popular amongst our community.

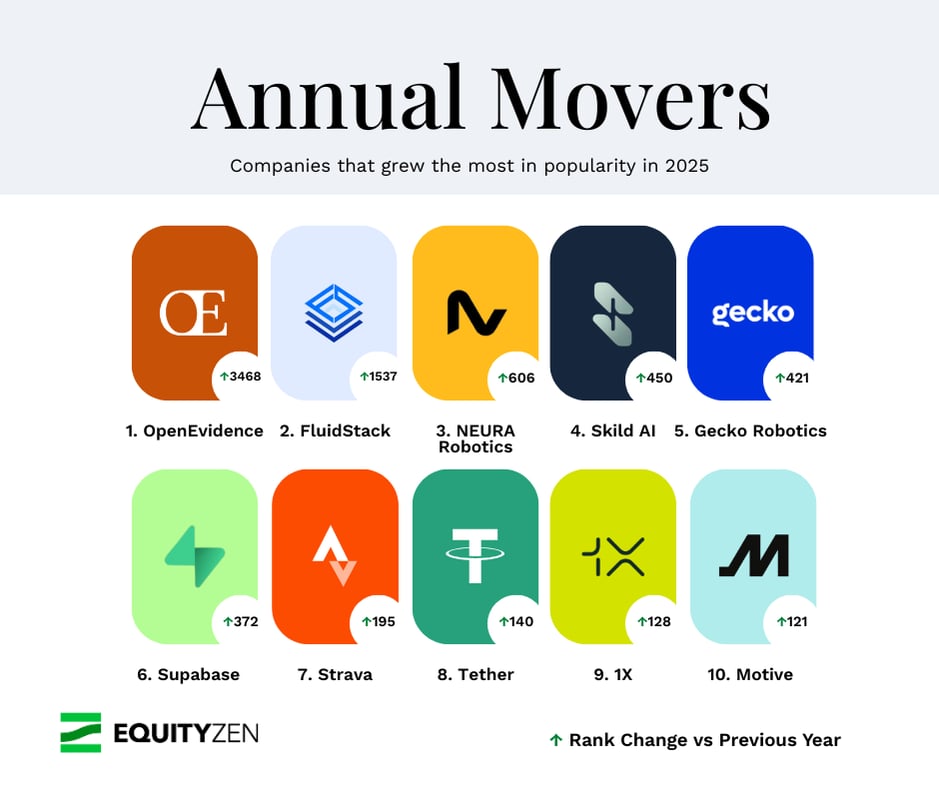

The list of most popular companies did not stay static, however. Several companies made their mark, growing the most in popularity this year. Robotics companies accounted for 40% of our top movers, showing how tech is moving to the physical world. Other companies spanned industries like data, blockchain, and consumer apps. 2025’s biggest “annual movers” were:

Democratizing Data and Access

This year, we focused heavily on breaking down the barriers that have historically kept individual investors on the sidelines. We did this through:

- Yahoo Finance Partnership: We believe that transparency drives liquidity. In 2025, we partnered with Yahoo Finance to bring private market data to the mainstream. Now, millions of users can see private market insights alongside private company tickers, closing the information gap between Wall Street and Main Street.

- $5K Investment Minimums: Access means nothing if the entry price is too high. We were proud to launch $5,000 investment minimums across many of our deals, empowering a new wave of investors to build diversified portfolios of pre-IPO companies without needing a massive capital allocation.

Product Innovation: Speed and Control

You asked for more control over your investments, and we listened.

- Launching "Bids": We flipped the script on the traditional secondary model. With the launch of Bids, investors can now proactively name their price for the offerings they want. This has created a more dynamic, efficient marketplace where liquidity meets opportunity on your terms.

- Faster First Investments: We know that in the fast-moving private markets, timing is everything. Through platform optimizations this year, we’ve seen a significant increase in the speed to first investment for new users, ensuring you can capture opportunities as soon as they arise.

Celebrating the Portfolio Wins

Our clients invested in some of the most innovative companies on the planet this year, from the leaders in Generative AI to breakthroughs in aerospace and fintech.

We also celebrated liquidity events alongside you. In 2025, we saw exits from 16 EquityZen portfolio companies, including high-profile IPOs and strategic M&A events from companies like Circle, CoreWeave and Klarna. Seeing thousands of clients realize returns from companies they backed early is the ultimate validation of our model.

Joining Forces with Morgan Stanley

The biggest news of the year was our acquisition by Morgan Stanley. This marks a pivotal moment not just for our team, but for the entire private market ecosystem. By joining forces with a global leader in financial services, we are poised to scale our mission, "Private Markets for the Public", faster than ever before. Morgan Stanley’s cap table management solutions combined with EquityZen’s best-in-class private shares marketplace will deliver end-to-end solutions to investors, shareholders, and issuers alike. This partnership validates the platform we’ve built with you, our clients, and sets the stage for a future where access to the innovation economy is the gold standard.

Looking Ahead to 2026

As we look toward 2026, our mission remains unchanged, but our capabilities are expanding. Through our partnership with Morgan Stanley and the continued engagement of our incredible client base, we are ready to bring you even more exclusive access, more robust data and educational resources, and streamlined execution.

To our clients, shareholders, and partners: Thank you. Thank you for growing with us, for challenging us to be better, and for believing in the power of the private markets.

Here’s to a prosperous 2026 in the private markets!

Ready to start your 2026 portfolio? Browse open investments or Log in to see your personalized dashboard.

Footnotes

- EquityZen data as of December 5, 2025

- This information is intended for informational purposes only and does not constitute a recommendation or personal financial advice. Use of this information is at the user's discretion and risk. All company names and logos are trademarks or registered trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Disclosure

Companies referenced do not equate to live/in-progress investment offerings. Not all pre-IPO companies will go public or be acquired, and not all IPOs or acquisitions are or will become successful investments. There are inherent risks in pre-IPO investments, including the risk of loss of the entire investment, illiquidity, and fluctuations in value and returns. Investors must be able to afford the loss of their entire investment.

.png?width=96&height=96&name=image%20(5).png)

-1.png?width=812&height=446&name=coming%20soon%20(1)-1.png)

.png?width=812&height=446&name=Q1%20(2).png)