In this article

Getting Started with Private Market Investing: Part I - Investments page + Indicating interest

Curious how to get started with private market investing. EquityZen's Investments page is where you’...

.png?width=96&height=96&name=image%20(5).png)

In Part III we introduced you to the Offering Document created by EquityZen's Investment Research team for each Standard investment offering. Now, you're ready to reserve your investment allocation. Here, we'll walk you through the Investment Process. Soon, you'll be well on your way to your first private market investment. Exciting!

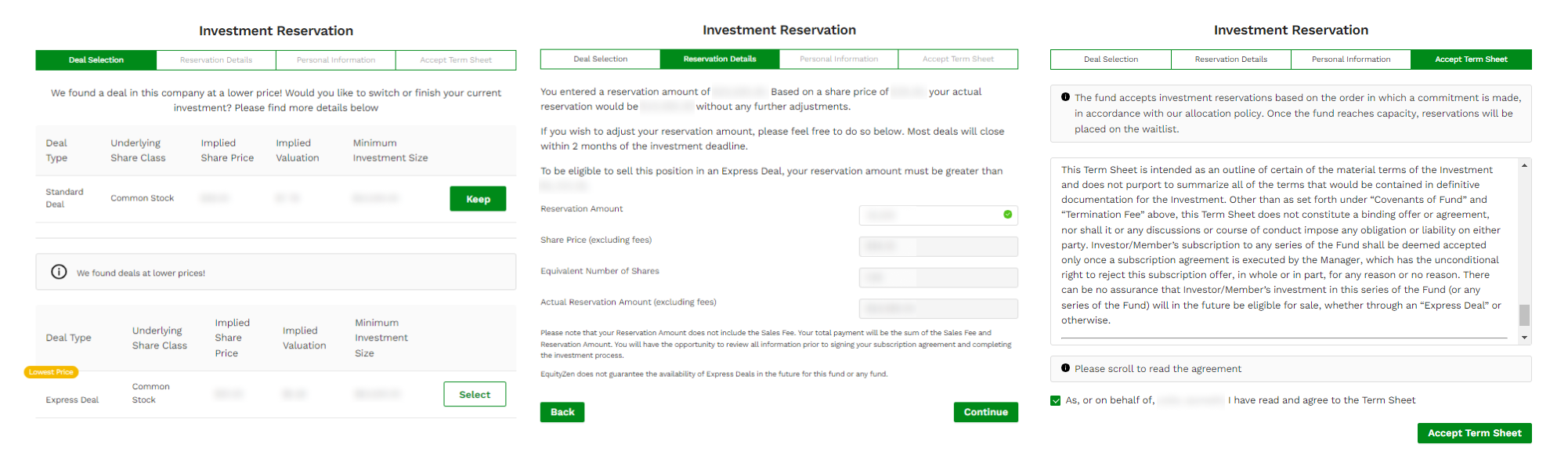

After reviewing the Offering Document for a specific single-company fund, you can begin the investment process by clicking 'Invest Now' at the top of the document and entering the amount you'd like to invest.

Next, you'll be prompted to provide personal information, including your address, phone number, entity type, and other details.

This will open up a new screen where you can complete your Investment Reservation by generating your Term Sheet and accepting the terms. Term Sheets are non-binding and simply hold your spot in a given investment opportunity.

Important: Once you've made an Investment Reservation you'll have 24 hours to complete the investment process. If you do not complete the investment process in time, your allocation will not be reserved. You can complete the process immediately after submitting your Investment Reservation or by clicking "Account" at the top right of your screen > “Portfolio” > "Ongoing" to view your current deals. Your investment allocation will be officially reserved once you finish the investment process and click “Submit Investment.”

From here, you can sit tight! EquityZen works with the selling shareholder(s) and company to submit the transfer and handle all subsequent steps, including the Right of First Refusal process, which typically takes 30 days. If you're curious about where we are in our process you can visit your Portfolio and look at your “Ongoing” investments to see the latest status.

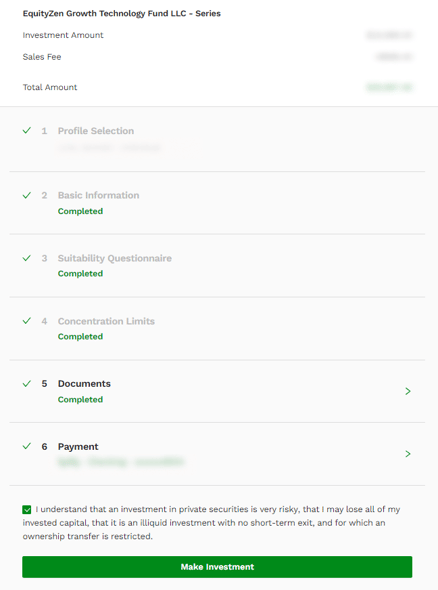

Many investors choose to complete these steps in advance from their account profile as most only need to be done once, even if you make multiple investments. Suitability Questionnaires need to be completed for each investment.

Here you'll also review and sign the binding Subscription Agreement and W-9. The subscription document officially confirms your investment in the fund.

Please note: Given the binding nature of the Subscription Agreement, once the company has been notified of the deal, you may not be able to cancel your investment. Any cancellations after signing the subscription agreement are at the discretion of the fund manager. If a cancellation is granted, it may incur a fee.

Finally, you'll confirm the bank details of the account you'll use to fund your investment.

Funds are not immediately required, and EquityZen will give investors notice to fund their accounts prior to calling capital. Funding can be completed via ACH (domestic only) or wire transfer (all international transfers must be sent through a wire). Prior to funding, we will notify you via email to confirm we will be withdrawing the capital on a specific date. If funding an investment via wire transfer, the transfer is initiated manually through your bank or using Wise (instructions for wires are provided in the “Porfolio” page for the specific investment). You can let us know when you’ve initiated the wire by selecting “I’ve initiated my transfer”.

Once the company waives its Right of First Refusal, we will begin the process of closing. This takes about two weeks and no action is needed from investors. If the company has exercised their Right of First Refusal and we are not able to move forward with an investment, the total of your investment amount and the sales fee will be refunded to your return bank account on file. We will try to give you priority if a new investment opportunity in this company becomes available in the future.

That’s it! When your investment closes you'll be notified via email that we have countersigned your Subscription Agreement. The Investment Summary and all of your related deal documents will be found under “Portfolio” and “Closed”. The “Closed” investments tab will summarize all of your previously closed transactions with EquityZen.

Congratulations on your first private markets investment!

For more information about all of our investment offerings, check out our Help Center. More questions? Feel free to reach out to us at support@equityzen.com.

Curious how to get started with private market investing. EquityZen's Investments page is where you’...

Not all investors have the same needs when it comes to private market investing. That’s why we’ve cr...

Discover how the rise of intelligent robotics is transforming industries and addressing labor shorta...

Investment opportunities posted on this website are "private placements" of securities that are not publicly traded, are subject to holding period requirements, and are intended for investors who do not need a liquid investment. Investing in private companies may be considered highly speculative and involves a high degree of risk, including the risk of substantial loss of investment. Investors must be able to afford the loss of their entire investment. See our Risk Factors for a more detailed explanation of the risks involved by investing through EquityZen’s platform.

EquityZen Securities LLC (“EquityZen Securities”) is a subsidiary of EquityZen Inc. EquityZen Securities is a broker/dealer registered with the U.S. Securities and Exchange Commission and is a FINRA/SIPC member firm.

Equity securities are offered through EquityZen Securities. Check the background of this firm on FINRA’s BrokerCheck.

EquityZen Inc. was awarded a 2024 Fintech Breakthrough Award by Tech Breakthrough LLC on March 19, 2025, based on the prior year and covering calendar year 2024, and has compensated FinTech Breakthrough LLC for use of its name and logo in connection with the award. FinTech Breakthrough LLC is a third party and has no affiliation with EquityZen.

EquityZen created the ticker symbols referenced on this page for use solely on the EquityZen platform. They do not refer to any publicly traded stock. EquityZen does not have an affiliation with, formal relationship with, or endorsement from any of the companies featured and none of the statements on the site should be attributed to those companies.

“Market Activity” and other transactional data displayed on this website is compiled by EquityZen and is confidential and historical in nature. Unauthorized use, distribution or reproduction is prohibited. Transactional information does not guarantee future investment results. EquityZen cannot guarantee finding or approving a transaction at any displayed price.

EquityZen.com is a website operated by EquityZen Inc. ("EquityZen"). By accessing this site and any pages thereof, you agree to be bound by our Terms of Use.

EquityZen and logo are trademarks of EquityZen Inc. Other trademarks are property of their respective owners.

© 2026 EquityZen. All rights reserved.

EquityZen

1 New York Plaza

12th floor

New York, NY 10004