In Part II we introduced you to EquityZen's investment products. In Part III we’ll discuss the Offering Document, which is the primary resource EquityZen provides investors with to help them evaluate investment opportunities.

Live investment opportunities are accessed by clicking on the company from the Investments page or via custom search. Our most common investment offering is a "Standard Deal". In this deal structure, investors can invest as little as $5,000 in a fund that will hold shares of a given private company. When there is a live Standard Deal, you’ll see a link to the offering on the left side under "Live Deals", previewing terms such as share class, price per share and implied valuation. To learn more, click "Invest Now". This will take you to the Offering Document for that particular Standard Deal.

To learn more about our other investment products, check out Part II of this series.

The Offering Document

The Offering Document is a one-stop shop to find a wealth of information about a particular investment offering. This includes specifics about that particular offering, publicly available information about the company, and EquityZen's analysis of the company's capitalization table, all prepared by EquityZen’s Research team. Below, we’ve highlighted some of the key sections.

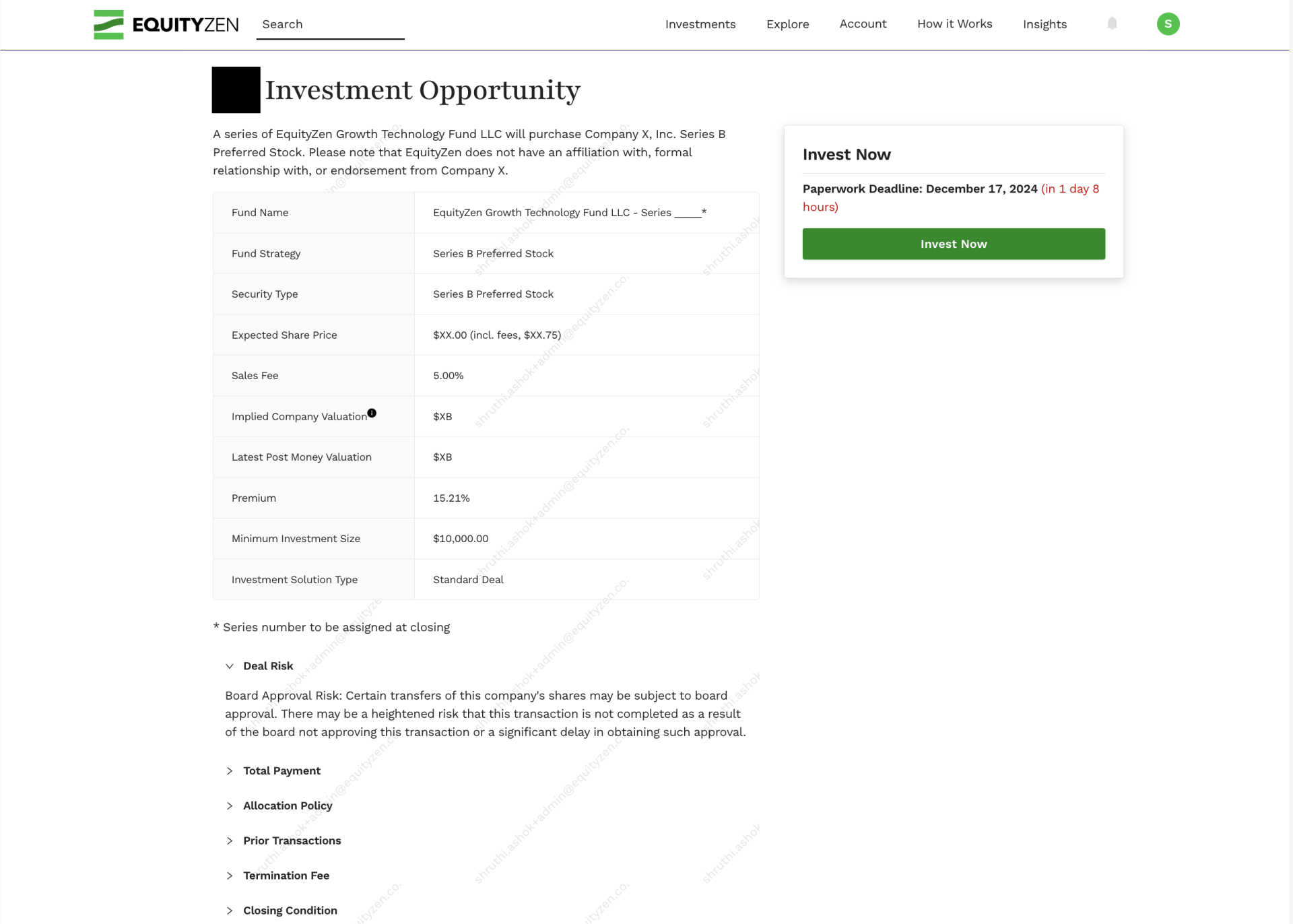

- Investment Opportunity: here you'll find information including security type, the implied valuation of the offering, the expected share price, the minimum Investment size, fees and more. You can also see information about when EquityZen last completed a transaction in that given company, if applicable. These details are all specific to this particular investment offering.

- The next few sections provide an overview of the company, including their business model, customer/user base, notable developments, management team, funding history, current investors, risk factors, and any other helpful, publicly available information compiled by our Research team.

This information helps investors better understand market opportunity, revenue potential, and other important details when considering an investment.

- Deal Risks: This section highlights key risks associated with the investment, such as right of first refusal or board approval.

- Finally, the Capitalization Table is EquityZen's proprietary analysis of the company's equity capitalization. This “Cap Table” reporting is built by our Research team and includes the various share classes and liquidity preferences across funding rounds, the amount of capital raised at each funding round, and estimates of the current shares outstanding and valuation as of the last funding round.

This information is primarily based on company fillings, along with other publicly available information sources that our Research team analyzes.

It’s important to understand the price you’ll be paying per share relative to the company’s last round of funding and any liquidity preferences when considering a private market investment. The cap table analysis provides this information.

Our Research team reviews and establishes a pricing range for every company in which we transact to ensure our pricing negotiations fall within that range. As a result, we only offer Standard Deals that we believe are fairly priced based on a proprietary analysis of the market, company and security.

Once you've reviewed the full Offering Document you may be excited about a particular investment opportunity and ready to make an investment. Congrats! In Part IV we'll walk you through the investment process.

For more information about all of our investment offerings, check out our Help Center. More questions? Feel free to reach out to us at support@equityzen.com.