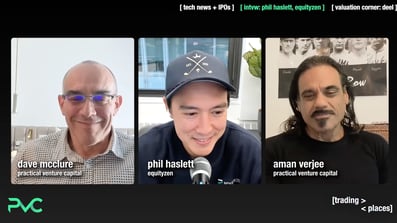

Morgan Stanley Wealth Management Reduces Fees on Private Shares Marketplace EquityZen, Broadening Private Markets Access

Morgan Stanley reduces EquityZen's transaction fees to 2.5%, enhancing access to private shares for investors and shareholders. Discover the benefits of for buyers and sellers of private stock.

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(9).png)

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(7).png)

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(4).png)

.png?width=406&height=223&name=Thumbnail%20(3).png)

-1.png?width=406&height=223&name=Not%20So%20Private%20Anymore%20(12)-1.png)

.jpg?width=406&height=223&name=shutterstock_542978641%20(1).jpg)

.jpg?width=406&height=223&name=shutterstock_1951565062%20(1).jpg)