EquityZen's 2026 IPO Outlook

2025 saw a resurgence in IPOs, especially for tech and AI-driven companies, setting the stage for a promising 2026 with high-growth IPO contenders.

The hub for private market news and education.

2025 saw a resurgence in IPOs, especially for tech and AI-driven companies, setting the stage for a promising 2026 with high-growth IPO contenders.

Morgan Stanley announces the acquisition of EquityZen, creating an unrivaled, end-to-end private markets solution. The deal links EquityZen's marketplace technology with Morgan Stanley at Work to offer seamless liquidity for private company shares and greater access for Wealth Management clients.

EquityZen's 2025 Year in Review highlights a year of growth, innovation, and new milestones in the private markets, driven by investor demand and a landmark acquisition by Morgan Stanley.

Stay ahead in the IPO market. Get the latest news, insights, and analysis on upcoming public debuts and market trends. Your hub for all things IPO in 2025.

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(9).png)

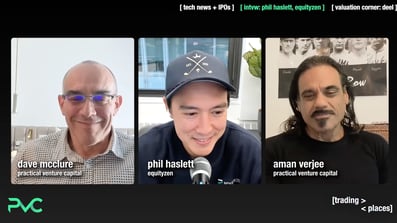

EquityZen’s Phil Haslett and Bri Lynch discuss the massive $720B energy demand driven by AI and how ...

Get EquityZen's 2026 IPO Outlook! Bri Lynch + Phil Haslett discuss the mature cohort (SpaceX, Databr...

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(7).png)

Dive into startup success with EquityZen CEO Atish Davda and Atomic's Nat Diston (first EquityZen em...

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(4).png)

Dive into Q3 pre-IPO market trends: Discover why AI dominates, how SaaS is making a "SaaSy comeback,...

Atish Davda and Ketan Bhalla share insights on product development, regulation, and the adoption of ...

.png?width=406&height=223&name=Thumbnail%20(3).png)

Learn the essential tools and due diligence process needed to research late-stage, pre-IPO companies...

EquityZen CEO Atish Davda & stablecoin expert Chuk Okpalugo break down the stablecoin market. Learn ...

Dive into the latest private market trends with EquityZen's Phil Haslett and Bri Lynch. Learn about ...

Investors are shifting focus to defense tech, funding startups that promise rapid, cost-effective ad...

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(9).png)

EquityZen’s Phil Haslett and Bri Lynch discuss the massive $720B energy demand driven by AI and how ...

Explore the evolution of pre-IPO secondaries with EquityZen Co-Founder Phil Haslett. Learn why compa...

Get EquityZen's 2026 IPO Outlook! Bri Lynch + Phil Haslett discuss the mature cohort (SpaceX, Databr...

Discover how AI-native SaaS companies are redefining growth with record-breaking speed and learn why...

Discover the trends shaping 2026 IPOs as mature unicorns like Cerebras and Kraken seek public exits,...

Discover how private market secondary pricing works, the significance of premiums and discounts, and...

Discover how AI-native SaaS companies are redefining growth with record-breaking speed and learn why...

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(7).png)

Dive into startup success with EquityZen CEO Atish Davda and Atomic's Nat Diston (first EquityZen em...

Atish Davda and Ketan Bhalla share insights on product development, regulation, and the adoption of ...

.jpg?width=406&height=223&name=shutterstock_542978641%20(1).jpg)

Explore how blockchain is driving cryptocurrency's growth, the technology behind it, and the opportu...

EquityZen Co-Founder Phil Haslett discusses the secondary market's evolution, major pre-IPO investme...

The path to IPO is longer than ever, with many private companies now over 10 years old. If you're a ...

EquityZen Co-Founder and Chief Strategy Officer Phil Haslett joins "QSBS, Solved" to break down why ...

New funding round? Learn how equity dilution affects private company stock ownership. Understand cap...

.jpg?width=406&height=223&name=shutterstock_1951565062%20(1).jpg)

Liquidity for shareholders, pre-IPO access for investors: SPVs make it happen in the private market....

Selling private tech shares isn't like public markets. Confused? Early employees need to know these ...

In the latest Fund/Build/Scale episode, Phil Haslett, Co-Founder of EquityZen, joins Walter Thompson...

Discover the trends shaping 2026 IPOs as mature unicorns like Cerebras and Kraken seek public exits,...

Could SpaceX's IPO be the largest ever? EquityZen's Phil Haslett weighs in on the $30B+ target and t...

Despite a late 2025 slowdown, the US IPO market is poised for a powerful reacceleration in 2026. Equ...

Brianne Lynch, EquityZen's Head of Market Insight, breaks down the biggest pre-IPO companies and the...

IPOs are surging, seeing their best month since 2021, fueled by a deep pipeline of over 1200 unicorn...

Brianne Lynch analyzes the 2025 IPO market. Discover why investors are prioritizing innovative tech ...

Navigating pre-IPO investing? It's complex. Learn 5 key factors to choose the right platform for gro...

Here is a guide on how to invest in single private companies on EquityZen's marketplace. We'll walk ...

Live investment opportunities are accessed by clicking on the company from the listings page. Our mo...

Not all investors have the same needs when it comes to private market investing. That’s why we’ve cr...

Curious how to get started with private market investing. EquityZen's Investments page is where you’...

Explore how EquityZen conducts thorough due diligence on private companies, ensuring investors make ...

Discover the trends shaping 2026 IPOs as mature unicorns like Cerebras and Kraken seek public exits,...

See key private market data from PitchBook's Q2 '25 VC Secondary Report, powered by EquityZen. Deman...

Download the State of Tech Exits H1 '25 Report by EquityZen + CB Insights. Analyze why private marke...

The 2025 IPO class proves the biggest gains happen pre-IPO. See our data comparing Series E vs. Publ...

Figma, founded in 2012, is poised for a $18 billion IPO in 2025, marking a decade of innovation and ...

Netskope, Inc. prepares for its IPO, achieving a $7.3B valuation after years of innovation in cloud ...

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(9).png)

EquityZen’s Phil Haslett and Bri Lynch discuss the massive $720B energy demand driven by AI and how ...

Explore the evolution of pre-IPO secondaries with EquityZen Co-Founder Phil Haslett. Learn why compa...

Get EquityZen's 2026 IPO Outlook! Bri Lynch + Phil Haslett discuss the mature cohort (SpaceX, Databr...

Could SpaceX's IPO be the largest ever? EquityZen's Phil Haslett weighs in on the $30B+ target and t...

.png?width=406&height=223&name=Blog%20Cover%20Videos!%20(7).png)

Dive into startup success with EquityZen CEO Atish Davda and Atomic's Nat Diston (first EquityZen em...

EquityZen CEO Atish Davda shares his gratitude for the company's growth, innovations, and future wit...

Get expert insights on shareholder strategies, pre-IPO investments, and market trends—straight to your inbox.

Investment opportunities posted on this website are "private placements" of securities that are not publicly traded, are subject to holding period requirements, and are intended for investors who do not need a liquid investment. Investing in private companies may be considered highly speculative and involves a high degree of risk, including the risk of substantial loss of investment. Investors must be able to afford the loss of their entire investment. See our Risk Factors for a more detailed explanation of the risks involved by investing through EquityZen’s platform.

EquityZen Securities LLC (“EquityZen Securities”) is a subsidiary of EquityZen Inc. EquityZen Securities is a broker/dealer registered with the U.S. Securities and Exchange Commission and is a FINRA/SIPC member firm.

Equity securities are offered through EquityZen Securities. Check the background of this firm on FINRA’s BrokerCheck.

EquityZen Inc. was awarded a 2024 Fintech Breakthrough Award by Tech Breakthrough LLC on March 19, 2025, based on the prior year and covering calendar year 2024, and has compensated FinTech Breakthrough LLC for use of its name and logo in connection with the award. FinTech Breakthrough LLC is a third party and has no affiliation with EquityZen.

EquityZen created the ticker symbols referenced on this page for use solely on the EquityZen platform. They do not refer to any publicly traded stock. EquityZen does not have an affiliation with, formal relationship with, or endorsement from any of the companies featured and none of the statements on the site should be attributed to those companies.

“Market Activity” and other transactional data displayed on this website is compiled by EquityZen and is confidential and historical in nature. Unauthorized use, distribution or reproduction is prohibited. Transactional information does not guarantee future investment results. EquityZen cannot guarantee finding or approving a transaction at any displayed price.

EquityZen.com is a website operated by EquityZen Inc. ("EquityZen"). By accessing this site and any pages thereof, you agree to be bound by our Terms of Use.

EquityZen and logo are trademarks of EquityZen Inc. Other trademarks are property of their respective owners.

© 2026 EquityZen. All rights reserved.

EquityZen

1 New York Plaza

12th floor

New York, NY 10004